Leasing a Kia Soul might seem like an enticing option, especially with low monthly payment deals advertised everywhere. However, before committing to a lease, it’s crucial to understand the full spectrum of costs involved. In this comprehensive guide, we delve into every aspect of leasing a Kia Soul, from initial expenses to end-of-lease considerations, empowering you to make informed decisions.

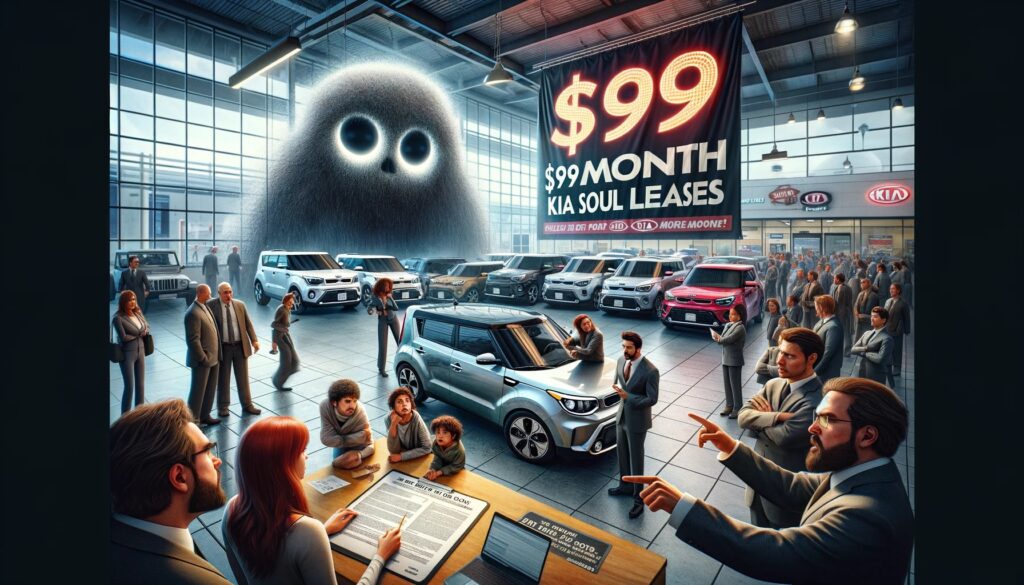

The Real Cost Behind $99/month Deals

Analyzing Advertised Lease Deals

Seemingly enticing $99/month lease deals for vehicles like the Kia Soul may catch the eye of prospective lessees. However, it’s essential to approach these offers with caution and skepticism. While the allure of a low monthly payment is undeniable, delving deeper reveals the true nature of these deals.

Hidden Costs in Fine Print

Upon closer examination of the fine print accompanying these $99/month lease offers, prospective lessees may uncover a myriad of hidden costs. These costs, often obscured from initial advertisements, can include:

- Security Deposits: Some leases require a security deposit upfront, which adds to the initial expense of leasing.

- Administrative Fees: Lessor-imposed administrative fees can inflate the total cost of leasing.

- Dealer Add-Ons: Dealerships may tack on additional fees for accessories or services, further increasing the overall expense.

Case Study: Real Costs of a $99/month Kia Soul Lease

In conducting a comprehensive analysis of a $99/month lease offer for the Kia Soul, we unearthed the true cost lurking beneath the surface. Despite the allure of the advertised monthly payment, our investigation revealed a stark reality:

- Substantial Upfront Costs: The $99/month figure fails to account for significant upfront costs, including down payments, drive-off fees, and acquisition fees.

- Exclusion of Taxes and Fees: Taxes, registration fees, and other charges may not be included in the $99/month offer, leading to unexpected expenses for lessees.

- Hidden Fees and Charges: Delving into the fine print of the lease agreement uncovered hidden fees, such as disposition fees and excess mileage charges, further inflating the total cost of leasing.

The Initial Costs of Leasing

Down Payment Explained

The down payment in a lease agreement is a critical factor that directly impacts both initial expenses and ongoing monthly payments. While opting for a lower down payment can alleviate immediate financial strain, it invariably translates to higher monthly lease payments over the duration of the lease term. Conversely, a higher down payment reduces monthly payments but requires a larger upfront investment.

When determining the optimal down payment amount, it’s essential to conduct a thorough evaluation of your financial situation. Consider factors such as:

- Budgetary Constraints: Assess your budget and ascertain how much you can comfortably allocate towards a down payment without jeopardizing your financial stability.

- Monthly Cash Flow: Analyze your monthly cash flow and determine the maximum amount you can afford to allocate towards lease payments without straining your finances.

- Long-Term Financial Goals: Consider your long-term financial goals and how the down payment will impact your ability to achieve them. Balancing immediate financial obligations with future aspirations is crucial in making an informed decision.

By carefully evaluating these factors, you can determine the optimal down payment amount that aligns with your financial circumstances and leasing objectives.

Drive-off Fees Breakdown

Understanding drive-off fees is imperative for lessees embarking on a leasing agreement. Drive-off fees encompass a spectrum of charges due at lease inception, which can vary depending on the lessor and specific lease terms. These fees typically include:

- Taxes: State and local taxes applicable to the leased vehicle.

- Title Fees: Charges associated with transferring the vehicle’s title to the lessee.

- License Fees: Costs incurred for registering the vehicle with the appropriate authorities.

- First Month’s Payment: The initial lease payment due at signing.

By comprehensively understanding the breakdown of drive-off fees, lessees can accurately anticipate and budget for the total cost of leasing a vehicle.

The Impact of Credit Score on Initial Costs

Your credit score wields significant influence over the terms and conditions of a lease agreement, particularly regarding initial costs. A higher credit score typically translates to more favorable lease terms, including:

- Lower Interest Rates: Lessees with higher credit scores are often eligible for lower interest rates, resulting in reduced overall leasing costs.

- Reduced Upfront Expenses: Lenders may offer incentives such as waived acquisition fees or reduced down payment requirements for lessees with excellent credit scores.

Conversely, individuals with lower credit scores may encounter higher interest rates and increased upfront expenses, thereby impacting the total cost of leasing.

Therefore, it’s imperative for prospective lessees to be cognizant of their credit score and its potential ramifications on lease terms. Taking proactive steps to improve creditworthiness, such as paying bills on time and reducing outstanding debt, can result in more favorable leasing terms and lower initial costs.

Ongoing Costs During the Lease

Monthly Payments and What They Include

Monthly lease payments encompass various components that contribute to the overall cost of leasing a vehicle. These payments primarily cover:

- Depreciation: The decrease in the vehicle’s value over time, which is factored into the lease payments.

- Interest: The cost of borrowing the funds to lease the vehicle, expressed as an annual percentage rate (APR).

- Taxes: State and local taxes applicable to the lease agreement.

It’s essential for lessees to be aware of any additional charges included in their monthly payment, such as:

- Insurance Premiums: Some lease agreements may include insurance premiums as part of the monthly payment, providing lessees with comprehensive coverage for the leased vehicle.

- Maintenance Costs: Certain lease agreements incorporate maintenance costs, covering routine service and repairs for the duration of the lease term.

By understanding the components of their monthly lease payment, lessees can effectively budget and plan for ongoing expenses.

Managing Mileage: Avoiding Excess Fees

Monitoring mileage throughout the lease term is crucial for lessees to avoid incurring costly excess mileage fees. Most lease agreements stipulate a predetermined mileage limit, typically ranging from 10,000 to 15,000 miles per year. Exceeding this limit can result in excess mileage charges, typically assessed on a per-mile basis.

To mitigate the risk of exceeding the mileage limit, lessees should consider:

- Estimating Annual Mileage: Calculate your anticipated annual mileage based on your driving habits and usage patterns.

- Purchasing Additional Mileage: Some lease agreements offer the option to purchase additional mileage upfront at a discounted rate, providing added flexibility and peace of mind.

By proactively managing mileage and planning accordingly, lessees can avoid unexpected fees and maintain control over their leasing expenses.

Maintenance and Insurance Costs

While maintenance costs are typically covered in lease agreements, insurance remains the responsibility of the lessee. It’s imperative for lessees to secure adequate insurance coverage for the leased vehicle, including:

- Liability Coverage: Protects against damages and injuries caused to others in an accident for which the lessee is deemed responsible.

- Collision Coverage: Covers repairs to the leased vehicle in the event of a collision with another vehicle or object.

- Comprehensive Coverage: Provides protection against non-collision-related incidents, such as theft, vandalism, and natural disasters.

Lessees should carefully review their insurance policies to ensure they meet the lessor’s requirements and provide comprehensive coverage for the leased vehicle. By addressing maintenance and insurance costs upfront, lessees can enjoy a hassle-free leasing experience and safeguard themselves against potential liabilities.

Lease Calculators and Tools

In the digital age, there is an abundance of online resources available to assist prospective lessees in navigating the complexities of leasing agreements and estimating associated costs. Lease calculators and online tools serve as invaluable resources, providing users with the ability to make informed decisions and assess the financial implications of leasing a vehicle.

Lease Calculator

How to Use Lease Calculators

Online lease calculators offer a user-friendly interface that allows individuals to input key variables and parameters related to their lease agreement. By entering factors such as the vehicle’s price, down payment amount, lease term, and applicable interest rate, users can generate estimates of total lease costs. These calculators typically provide detailed breakdowns of monthly payments, including depreciation, interest, taxes, and fees, enabling users to gain insight into the financial commitment associated with leasing a vehicle.

To utilize a lease calculator effectively, follow these steps:

- Input Vehicle Information: Enter the vehicle’s price, including any optional features or upgrades, as well as the manufacturer’s suggested retail price (MSRP).

- Specify Lease Terms: Indicate the desired lease term, typically expressed in months, and the applicable interest rate or money factor.

- Enter Down Payment: Input the amount of the down payment, if any, to be made at lease inception.

- Consider Additional Costs: Factor in any additional fees or charges, such as taxes, registration fees, and acquisition fees.

- Review Results: Review the calculated estimates of monthly lease payments, total lease costs, and other relevant financial metrics.

By leveraging lease calculators, individuals can gain valuable insights into the financial implications of leasing a vehicle and make informed decisions based on their unique circumstances and preferences.

Online Tools for Estimating Total Lease Cost

In addition to lease calculators, a plethora of online tools and resources are available to assist individuals in estimating total lease costs and comparing lease offers from different providers. These tools typically offer features such as:

- Comparison Tools: Allows users to compare lease offers from multiple dealerships or leasing companies side by side, facilitating informed decision-making.

- Payment Calculators: Enables users to calculate monthly lease payments based on varying parameters and scenarios.

- Lease Analysis: Provides detailed analyses of lease terms, including residual values, depreciation rates, and total lease costs over the term.

By exploring these online tools and resources, individuals can gain a comprehensive understanding of lease offers available in the market, evaluate their financial implications, and ultimately select the lease agreement that best aligns with their needs and preferences.

Shopping for the Best Lease Deal

When embarking on the journey of leasing a vehicle, it’s imperative to approach the process with diligence and discernment. Shopping for the best lease deal involves thorough research, careful consideration of offers, and strategic negotiation tactics to secure favorable terms and avoid hidden fees.

Comparing Offers from Different Dealerships

To ensure you’re getting the best deal possible, it’s essential to cast a wide net and compare lease offers from multiple dealerships. Each dealership may offer varying terms, incentives, and promotions, making it crucial to explore all available options. By soliciting quotes from different dealerships and comparing them side by side, you can identify the most competitive offers and leverage them to negotiate more favorable terms.

Negotiating Lease Terms

Don’t underestimate the power of negotiation when it comes to lease terms. Dealerships are often willing to negotiate various aspects of the lease agreement, including the purchase price, interest rate, and lease term. Before entering negotiations, conduct research to understand market trends, vehicle pricing, and lease incentives. Approach negotiations with confidence and be prepared to articulate your desired terms clearly. By advocating for yourself and demonstrating your willingness to walk away if necessary, you can potentially secure a more advantageous lease agreement.

Tips for a No-Hidden-Fee Lease Deal

In the realm of leasing, transparency is paramount. To safeguard against hidden fees and ensure a no-surprises leasing experience, adhere to the following tips:

- Ask Questions: Don’t hesitate to ask questions and seek clarification on any unclear terms or conditions in the lease agreement. A reputable dealership will be transparent and forthcoming with information.

- Review Thoroughly: Carefully review the lease agreement in its entirety, paying close attention to fine print and potential hidden clauses. Take note of any fees, charges, or penalties outlined in the agreement.

- Seek Clarification: If you encounter terms or language in the lease agreement that are ambiguous or confusing, seek clarification from the dealership or leasing agent. It’s better to address concerns upfront than to be blindsided by unexpected fees later on.

- Document Everything: Keep detailed records of all communications, negotiations, and agreements with the dealership. Having documentation to reference can provide added protection and clarity in the event of disputes or discrepancies.

By adopting a proactive and vigilant approach to lease shopping and negotiation, you can maximize your chances of securing a no-hidden-fee lease deal that aligns with your budget and preferences.

Reading and Understanding the Lease Agreement

When entering into a lease agreement for a vehicle, it’s essential to approach the process with caution and meticulous attention to detail. Reading and understanding the lease agreement thoroughly can help lessees avoid potential pitfalls and ensure a smooth and transparent leasing experience.

Key Clauses in the Agreement

Pay close attention to key clauses in the lease agreement, as they outline important terms and conditions that govern the leasing arrangement. Some critical clauses to focus on include:

- Mileage Restrictions: Take note of any mileage limitations specified in the lease agreement, as exceeding these limits can result in costly excess mileage fees.

- Wear and Tear Guidelines: Familiarize yourself with the wear and tear guidelines outlined in the lease agreement, which dictate the acceptable condition of the vehicle upon return.

- Early Termination Penalties: Be aware of any penalties or fees associated with terminating the lease agreement prematurely, as these can have significant financial implications.

Understanding these key clauses is paramount to ensuring compliance with the terms of the lease agreement and avoiding potential penalties or disputes.

Red Flags in Lease Contracts

Be vigilant for red flags in lease contracts that may signal potential issues or unfavorable terms. Some warning signs to watch out for include:

- Ambiguous Language: Beware of lease contracts that contain vague or ambiguous language, as this can lead to misunderstandings or disputes down the line.

- Undisclosed Fees: Scrutinize the lease agreement for any undisclosed fees or charges that could inflate the total cost of leasing.

- Unfavorable Terms: Pay attention to terms that seem disproportionately favorable to the lessor or impose undue burdens on the lessee.

If you encounter any red flags or concerns while reviewing the lease contract, consider seeking clarification from the lessor or consulting with a legal professional for guidance.

Seeking Professional Advice

When in doubt, it’s always advisable to seek professional advice before signing a lease agreement. Consider consulting with a financial advisor or leasing expert who can provide insights and guidance tailored to your specific situation. A knowledgeable advisor can help you navigate the complexities of the lease agreement, clarify any confusing terms, and ensure that you fully understand your rights and obligations as a lessee.

By proactively seeking professional advice and thoroughly reviewing the lease agreement, you can mitigate risks, protect your interests, and make informed decisions that align with your financial goals and preferences.

Real-world Examples of Kia Soul Lease Deals

Exploring real-world examples of Kia Soul lease deals offers valuable insights into the leasing landscape, allowing prospective lessees to assess competitiveness and identify potential opportunities for securing favorable terms.

Analysis of Performance Kia in Moosic, PA Deal

Performance Kia in Moosic, PA, offers a lease deal on the Kia Soul that merits close examination. By analyzing this deal and comparing it to industry standards, prospective lessees can gauge its competitiveness and determine if it aligns with their leasing preferences and budgetary constraints. Factors to consider in this analysis include lease terms, monthly payments, down payment requirements, and any additional fees or incentives offered by the dealership.

Review of LeaseTrader’s Offer

LeaseTrader provides an online marketplace for lease transfers, offering an alternative option for individuals seeking to lease a Kia Soul. By leveraging LeaseTrader’s platform, lessees may find opportunities to assume an existing lease on a Kia Soul, potentially bypassing traditional dealership negotiations and securing favorable terms. Prospective lessees should carefully review LeaseTrader’s offerings, considering factors such as lease duration, monthly payments, and any transfer fees involved.

Comparing Regional and National Deals

Regional lease offers for the Kia Soul may vary significantly from national deals, influenced by factors such as local market conditions, dealership incentives, and regional demand. Therefore, it’s essential for prospective lessees to explore all available options in their area, including both regional and national deals, to identify the most competitive offers. By conducting thorough research and comparison shopping, lessees can maximize their chances of securing a lease deal that meets their needs and offers optimal value.

Final Considerations Before Leasing

Before committing to a lease agreement for a Kia Soul, it’s essential to carefully weigh the various factors and considerations to ensure that leasing aligns with your financial goals and lifestyle preferences.

Pros and Cons of Leasing a Kia Soul

Pros:

- Lower Monthly Payments: Leasing typically involves lower monthly payments compared to financing a vehicle through a loan, making it more budget-friendly in the short term.

- Access to Newer Vehicles: Leasing allows you to drive a newer vehicle with the latest features and technology, providing a sense of luxury and convenience.

- Limited Maintenance Responsibilities: Lease agreements often include maintenance packages, reducing the lessee’s responsibility for routine service and repairs.

Cons:

- Limited Ownership Benefits: Unlike purchasing a vehicle outright, leasing does not provide ownership equity or the ability to customize the vehicle to your preferences.

- Mileage Restrictions: Lease agreements typically impose mileage limitations, and exceeding these limits can result in costly excess mileage fees.

- End-of-Lease Costs: Lessees may incur additional costs at the end of the lease, such as disposition fees and excess wear and tear charges.

Long-Term Financial Implications

Before committing to a lease agreement, consider the long-term financial implications of leasing a Kia Soul. While leasing may offer lower monthly payments and access to newer vehicles, it’s essential to evaluate potential costs at the end of the lease term. Lessees should also consider limitations on vehicle customization and the absence of ownership equity when leasing.

Alternative Options to Leasing

Exploring alternative financing options and vehicle models is crucial before finalizing a lease agreement for a Kia Soul. Consider purchasing a new or used vehicle outright, which provides ownership equity and the flexibility to customize the vehicle to your preferences. Additionally, explore other Kia models with different financing options, such as financing a purchase through a loan or exploring lease-to-own options.

By carefully evaluating the pros and cons of leasing, considering long-term financial implications, and exploring alternative options, you can make an informed decision that aligns with your budget, lifestyle, and future plans. Ultimately, the choice between leasing a Kia Soul and other financing options depends on your individual preferences and financial circumstances.

Frequently Asked Questions (FAQs)

What is the typical down payment for a Kia Soul lease?

The typical down payment for a Kia Soul lease can vary depending on the lease terms, dealership policies, and individual financial circumstances. In general, down payments for lease agreements are often lower than those required for vehicle purchases. Some lease agreements may even offer zero-down options, allowing lessees to minimize upfront expenses. It’s advisable to inquire with the dealership or leasing company to determine the specific down payment requirements for the Kia Soul lease you’re considering.

Are drive-off fees negotiable?

Drive-off fees, which encompass various charges due at lease inception, including taxes, registration fees, and the first month’s payment, may be negotiable to some extent. While certain fees, such as taxes and government-mandated charges, are typically non-negotiable, other fees, such as acquisition fees or dealer add-ons, may be subject to negotiation. Prospective lessees can leverage their negotiation skills and market research to seek reductions or waivers for certain drive-off fees. It’s advisable to discuss potential negotiation opportunities with the dealership or leasing agent to explore available options.

How can I avoid excess mileage fees?

To avoid excess mileage fees when leasing a Kia Soul, it’s essential to carefully monitor your mileage throughout the lease term and adhere to the mileage limit specified in the lease agreement. Most lease agreements stipulate an annual mileage allowance, typically ranging from 10,000 to 15,000 miles per year. Exceeding this limit can result in costly excess mileage fees assessed at the end of the lease term. Lessees can mitigate the risk of exceeding the mileage limit by:

- Estimating Annual Mileage: Calculate your anticipated annual mileage based on your driving habits and usage patterns.

- Purchasing Additional Mileage: Some lease agreements offer the option to purchase additional mileage upfront at a discounted rate, providing added flexibility and peace of mind.

By proactively managing mileage and planning accordingly, lessees can avoid unexpected fees and maintain compliance with the terms of the lease agreement.

What happens if I want to terminate my lease early?

If you wish to terminate your Kia Soul lease agreement before the scheduled end date, you may incur early termination penalties and fees. Early termination typically involves paying the remaining lease payments, plus any applicable penalties, which can amount to a significant financial burden. Additionally, terminating a lease early may negatively impact your credit score and financial standing. Before considering early lease termination, it’s advisable to review the terms of your lease agreement, assess the associated costs and penalties, and explore alternative options, such as lease transfer or lease buyout. Consulting with the dealership or leasing company can provide insights into the process and potential consequences of early lease termination.

Is it more cost-effective to lease or buy a Kia Soul?

Determining whether it’s more cost-effective to lease or buy a Kia Soul depends on various factors, including your individual financial situation, preferences, and driving habits. Leasing may offer lower monthly payments and provide access to newer vehicles with the latest features and technology, making it an attractive option for some consumers. However, leasing also entails limitations, such as mileage restrictions, lack of ownership equity, and potential end-of-lease costs. On the other hand, purchasing a Kia Soul outright provides ownership equity, flexibility for customization, and the ability to drive the vehicle for an extended period without mileage constraints. Before deciding between leasing and buying, it’s essential to carefully evaluate the long-term financial implications, consider your lifestyle and driving needs, and weigh the pros and cons of each option. Consulting with a financial advisor or automotive expert can help you make an informed decision that aligns with your goals and preferences.

Conclusion

In conclusion, leasing a Kia Soul can be a viable option for many consumers, but it’s essential to thoroughly understand the true costs involved. By educating yourself on lease terms, analyzing lease offers, and considering all financial implications, you can make a smart and informed decision. Remember to research, negotiate, and consult with professionals to ensure you get the best possible lease deal for your needs. Take control of your leasing experience and drive away with confidence.

Call to Action

Reach out to your local Kia dealership to explore lease options and schedule a test drive today. Share your leasing experiences and insights with others in the community, and don’t hesitate to seek personalized advice from financial advisors or leasing experts. Your journey to leasing a Kia Soul starts now!

LeaseTrader is advertising a lease on a 2021 Kia Forte LXS for $99 per month with $1,836 down.