When it comes to purchasing a car, the quest for the most favorable auto loan interest rates becomes a pivotal factor that can significantly impact your financial health. The distinction between high and low interest rates can translate into thousands of dollars saved or spent over the life of your loan. In this comprehensive guide, we delve into the intricate world of auto loan interest rates, equipping you with the knowledge and strategies necessary to secure the most competitive rates available.

Unraveling the Complexities of Auto Loan Interest Rates

Auto loan interest rates form the bedrock of the cost associated with borrowing money to finance a vehicle. These rates represent a percentage of the loan amount that lending institutions impose as a charge for granting you access to their funds. It’s vital to recognize that a higher interest rate translates to greater interest payments throughout the duration of the loan. Mastery of these rates is pivotal for making well-informed financial decisions.

Navigating Advertised vs. Actual Rates

Lenders frequently tout their lowest possible interest rates in advertisements, but it’s crucial to understand that these rates might not be the ones you ultimately qualify for. Your actual interest rate hinges on a multitude of variables, including your credit score, the duration of the loan, and the specific vehicle you intend to purchase. Recognizing the distinction between advertised rates and those you’ll genuinely secure empowers you to embark on your car-buying journey with realistic expectations.

Key Players and Their Competitive Interest Rates

In the competitive landscape of auto loans, several lenders stand out for offering enticing interest rates that can reshape your financial landscape. At the forefront is AutoPay, boasting an impressive 2.99% APR for loan terms spanning from 24 to 96 months. PenFed Credit Union emerges as a robust contender with a 5.24% APR tailored to loan terms between 36 to 84 months. Auto Approve beckons with a 2.94% APR available for 12 to 84-month loan terms, while Consumers Credit Union extends a viable option featuring a 5.54% APR for terms of up to 84 months.

Unveiling the Significance of Loan Term Length

The length of your chosen loan term emerges as a pivotal factor influencing both your interest rate and monthly payments. Brief loan terms usually come coupled with lower interest rates, driven by the decreased risk they pose to lenders. On the contrary, elongated loan terms may trigger higher interest rates but pave the way for more manageable monthly payments. The merits and demerits of each option warrant meticulous exploration.

AutoPay: The Epitome of Low Interest Rates

AutoPay garners its reputation as a go-to lender renowned for its low interest rates, a distinction that stands firmly justified. Flaunting an APR of 2.99%, AutoPay extends a captivating proposition to borrowers. Moreover, the flexibility inherent in their loan term spectrum, spanning from 24 to 96 months, accommodates a sweeping range of financial circumstances, ensuring inclusivity.

PenFed Credit Union: Pioneering Competitive Rates

In the realm of credit unions, PenFed Credit Union shines as a beacon of competitive interest rates. Its 5.24% APR stands as a testament to its commitment to delivering value to its members. Loan terms ranging from 36 to 84 months solidify its position as a flexible and accommodating option, tailor-made to suit diverse borrower needs.

Auto Approve: Delving into the Nuances

The alluring APR of 2.94% beckons borrowers to consider Auto Approve as a top choice for securing low interest rates. The gamut of loan term options spanning from 12 to 84 months underscores their versatility in catering to multifaceted requirements. However, a prudent approach entails thorough comprehension of their specific terms and prerequisites before embarking on a decision.

Consumers Credit Union: Navigating the Possibilities

Consumers Credit Union extends a viable proposition with an APR of 5.54%, positioning itself as a potential ally for select borrowers. Their extended loan term of up to 84 months offers a distinct advantage in terms of repayment period. Scrutinizing borrower profiles that align with their offerings and evaluating pertinent considerations is imperative for maximizing the benefits they offer.

Deciphering Factors That Shape Your Interest Rate

Apprehending that your individualized interest rate hinges on more than just the lender’s discretion is paramount. A myriad of elements coalesce to define this rate, including your credit score, the quantum of the loan, the nature of the vehicle, and the duration of the loan. A comprehensive understanding of these factors empowers you to take calculated actions that enhance your prospects of securing a competitive rate.

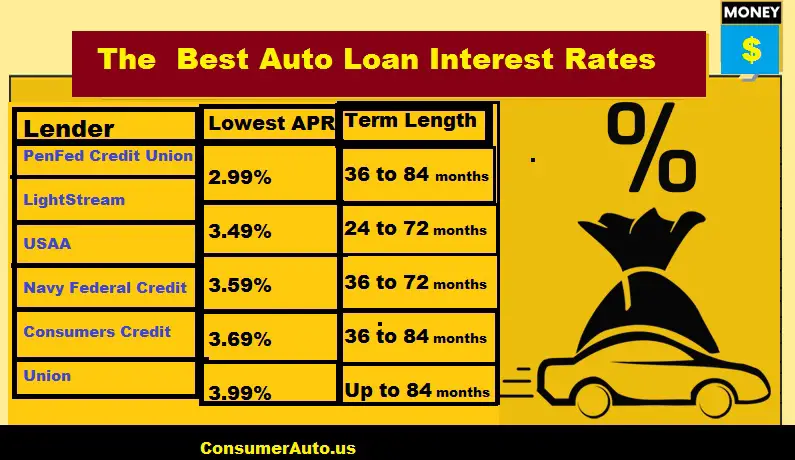

The bank with the lowest interest rate for auto loans in the United States is PenFed Credit Union. As of August 2023, PenFed Credit Union is offering an APR of 2.99% for auto loans with terms of 36 to 84 months. This is the lowest interest rate that I have found from any bank or credit union.

Here is a table of the lowest interest rates for auto loans from some of the top lenders in the United States

| Lender | Lowest APR | Term Length |

| PenFed Credit Union | 2.99% | 36 to 84 months |

| LightStream | 3.49% | 24 to 72 months |

| USAA | 3.59% | 36 to 72 months |

| Navy Federal Credit Union | 3.69% | 36 to 84 months |

| Consumers Credit Union | 3.99% | Up to 84 months |

The Crucial Role of Credit Scores

Your credit score occupies a pivotal space in the lender’s assessment of your creditworthiness. Higher credit scores correlate with lower interest rates, a correlation that substantiates the significance of maintaining a healthy credit profile. Insight into the mechanisms through which credit scores influence your auto loan interest rate, coupled with actionable tips for bolstering your score before initiating the loan application process, becomes your prerogative.

Selecting the Optimal Loan Term

The choice of loan term necessitates a calibrated approach, effectively balancing the scale. Opting for a shorter loan term entails higher monthly payments but offsets this with reduced overall interest costs. Conversely, embracing a longer loan term alleviates immediate financial burden but could incur higher interest expenses in the long haul. A guided journey through this decision-making labyrinth ensures your financial alignment.

The Power of Scouring for the Most Favorable Deal

Harnessing the power of comparison shopping emerges as one of the most potent strategies for securing a favorable auto loan interest rate. Garnering quotes from multiple lenders empowers you to discern the nuances of each offer and subsequently choose the one that seamlessly dovetails with your financial aspirations. Practical guidance on the art of gathering and contrasting these quotes positions you to unearth the most captivating deal.

Mastering the Art of Negotiation

Empowering yourself with negotiation skills amplifies your capacity to secure an interest rate that tilts in your favor. Delving into effective negotiation strategies and leveraging disparate offers from various lenders metamorphoses into a dynamic tool for driving substantial savings over the loan’s lifespan. Embracing a proactive stance in the negotiation arena underscores your commitment to optimal financial outcomes.

Demystifying the Preapproval Process

Preapproval emerges as an invaluable asset in your pursuit of a favorable auto loan interest rate. The process of securing preapproval confers insights into the anticipated interest rate, equipping you with the knowledge required for enlightened decisions. Traversing the intricate steps of the preapproval process unravels its far-reaching impact on your prospective interest rate, bolstering your bargaining prowess.

What Constitutes Auto Loan Interest Rates and Their Relevance?

Deciphering the Disparity Between Advertised and Actual Interest Rates

Q: Why do advertised auto loan interest rates often differ from the actual rates offered?

Advertised auto loan interest rates can be misleading due to their promotional nature. Actual rates are influenced by individual financial factors, such as credit history, income, and loan amount.

Important Information:

- Advertised rates serve as attention-grabbers but may not reflect personal circumstances.

- Actual rates are customized based on borrower-specific criteria.

- Factors like creditworthiness and market conditions impact the final rate.

Unveiling the Elements That Shape Individualized Interest Rates

Q: What factors contribute to the determination of individualized auto loan interest rates?

Several key elements shape personalized interest rates, including credit score, loan term, down payment, and prevailing market conditions.

Important Information:

- Credit score is a crucial factor; higher scores often secure lower rates.

- Loan term length affects rates, with shorter terms generally yielding lower rates.

- A significant down payment can lead to a reduced interest rate.

Decoding the Dilemma: Shorter vs. Longer Loan Terms

Q: Should I opt for a shorter or longer loan term to obtain a favorable interest rate?

Choosing between a shorter or longer loan term depends on your financial goals. Short terms may offer lower rates but higher monthly payments, while longer terms have lower monthly payments but potentially higher overall interest costs.

Important Information:

- Shorter terms save money on interest but demand higher monthly payments.

- Longer terms offer lower monthly payments but might result in higher overall interest expenses.

- Consider your budget, financial stability, and preferred payment structure.

Unraveling the Aura of AutoPay: Leader in Low-Interest Rates

Q: How does enrolling in AutoPay contribute to securing low-interest rates on auto loans?

AutoPay, where monthly payments are automatically deducted, showcases borrower reliability, leading lenders to reward customers with reduced interest rates.

Important Information:

- AutoPay demonstrates consistent payments, enhancing your creditworthiness.

- Lenders may offer rate discounts as a gesture of appreciation for reliable payments.

- Setting up AutoPay is a straightforward process that promotes financial discipline.

Credit Score’s Influence on Auto Loan Interest Rate: Probing the Nexus

Q: How does my credit score impact the interest rate I receive on an auto loan?

Credit scores are a pivotal factor in determining auto loan interest rates. Higher credit scores often correlate with lower rates, while lower scores might lead to higher rates due to perceived risk.

Important Information:

- Credit scores reflect creditworthiness; better scores signify lower risk.

- Lenders use credit tiers to assign interest rates, favoring higher tiers.

- Monitoring and improving your credit score can lead to better loan terms.

Credit Union Membership’s Role in Securing Competitive Rates

Q: How does being a credit union member influence the interest rates for auto loans?

Credit unions, known for their member-focused approach, frequently offer competitive interest rates and terms to their members due to their nonprofit status.

Important Information:

- Credit unions prioritize members’ financial well-being, resulting in favorable rates.

- Membership eligibility criteria may vary; research local credit unions.

- Joining a credit union can provide access to exclusive loan offers.

Harnessing Negotiation to Secure an Optimal Interest Rate

Q: Can I negotiate with lenders for a better auto loan interest rate?

Yes, negotiation is possible. Comparing offers from multiple lenders and leveraging your creditworthiness can lead to securing a more favorable interest rate.

Important Information:

- Research different lenders and their rates to have negotiation leverage.

- Highlight your creditworthiness, income stability, and willingness to commit.

- Negotiating effectively requires confidence, preparedness, and clear communication.

Impact of Preapproval on Auto Loan Interest Rate: A Deeper Dive

Q: How does obtaining preapproval for an auto loan affect the eventual interest rate?

Preapproval provides insight into your potential loan terms, allowing you to shop confidently. While preapproval rates are not final, they offer a close estimate based on your credit profile.

Important Information:

- Preapproval offers an approximate rate range, aiding your car search.

- Actual rates might vary slightly during the final approval process.

- Preapproval expedites the purchasing process and streamlines negotiations.

Practical Steps for Elevating Your Credit Score Ahead of an Auto Loan Application

Q: What practical measures can I take to improve my credit score before applying for an auto loan?

- Manage Timely Payments: Pay bills on time to showcase financial responsibility.

- Reduce Debt: Minimize existing debts to lower your credit utilization ratio.

- Review Credit Report: Regularly review your credit report for inaccuracies and address them promptly.

Important Information:

- Timely payments and responsible credit use enhance your credit score.

- Lowering credit utilization signals fiscal prudence to lenders.

- Monitoring and rectifying credit report errors can boost your score significantly.

In conclusion, understanding the intricacies of auto loan interest rates is crucial when seeking a favorable loan agreement. Advertised rates differ from actual rates, which are tailored to individual circumstances. Personal factors, credit unions, negotiation skills, and credit score management all play vital roles in securing competitive rates. Whether through credit improvement or strategic decisions, borrowers can navigate the realm of auto loan interest rates with confidence.

In Conclusion

Navigating the labyrinthine landscape of auto loan interest rates mandates a strategic combination of diligent research, comprehensive comprehension, and shrewd decision-making. Awareness of the intricate interplay between credit scores, loan terms, and the power of negotiation empowers you to orchestrate your financial destiny with precision. The modest difference in interest rates becomes the fulcrum upon which substantial savings hinge over time. Armed with the insights garnered from this guide, you embark on a voyage poised to harness the best-suited auto loan interest rates aligned with your individual circumstances and aspirations.

Experience a paradigm shift in your pursuit of the ideal auto loan interest rates. By assimilating the intricate interplay of factors, honing negotiation skills, and exploring alternative lenders, you chart a trajectory towards financial empowerment. The roadmap is clear: grasp the nuances, master the art, and emerge triumphant in your pursuit of the most competitive auto loan interest rates.