When it comes to vehicle-related transactions in Texas, completing a vehicle title transfer is a crucial and legally required step. Whether you’re buying, selling, inheriting, or donating a vehicle, this process ensures that the ownership is officially transferred from one party to another. In this comprehensive guide, we will walk you through the intricacies of the Texas vehicle title transfer process, providing you with a step-by-step outline to navigate it successfully.

Understanding Texas Vehicle Title Transfer

What is a Vehicle Title Transfer?

A vehicle title transfer is a legal process that involves changing the ownership of a vehicle from one individual or entity to another. In Texas, it is essential for buyers and sellers alike, as it ensures that the new owner is officially recognized by the state as the vehicle’s legal owner.

Why is it Necessary?

There are several reasons why completing a vehicle title transfer is necessary. Firstly, it is a legal requirement by the Texas Department of Motor Vehicles (DMV). Secondly, it protects both the buyer and the seller by establishing a clear record of ownership, reducing the risk of fraud or disputes in the future. Finally, a proper title transfer is essential for registering the vehicle and obtaining license plates.

Documents Required for Title Transfer

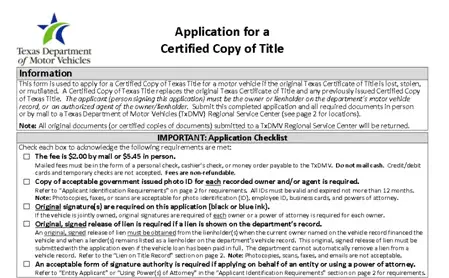

To successfully complete a title transfer in Texas, you will typically need the following documents:

- The vehicle’s current title properly signed by the seller.

- A completed Application for Texas Title and/or Registration (Form 130-U).

- A valid form of identification for both the buyer and the seller.

- Proof of insurance for the new owner.

- A lien release, if applicable.

- Any additional required documents based on specific circumstances, such as gift or inheritance.

Purchasing a Vehicle and Title Transfer

Steps to Take when Buying a Vehicle

- Research the Vehicle: Before purchasing a vehicle, conduct thorough research to ensure it meets your needs and preferences. Consider factors such as make, model, year, mileage, and any specific features you require.

- Obtain a Vehicle History Report: Obtain a comprehensive vehicle history report to check for any potential issues such as accidents, title problems, or odometer discrepancies.

- Inspect the Vehicle: Physically inspect the vehicle for signs of damage or irregularities. If you’re not familiar with assessing a vehicle’s condition, consider getting a professional inspection.

- Negotiate the Price: Negotiate the price with the seller and reach a fair agreement. Be prepared to walk away if the price doesn’t align with the vehicle’s value or condition.

- Finalize the Sale: Once a price is agreed upon, finalize the sale and obtain a bill of sale that documents the transaction.

Verifying Vehicle Ownership and Required Documents

- Obtain the Vehicle Title: Ensure the seller provides you with the current and valid vehicle title. Verify that the information on the title matches the vehicle and the seller’s identification.

- Verify the Vehicle Identification Number (VIN): Match the VIN on the title with the VIN on the vehicle to ensure they match. This step is crucial to avoid potential fraud or mismatches.

- Secure a Bill of Sale: Prepare a bill of sale, documenting the transaction’s details, including the vehicle’s purchase price and the date of sale. Both the buyer and the seller should keep a copy for their records.

- Complete the Application for Texas Title and/or Registration (Form 130-U): Fill out the necessary form to initiate the title transfer process. Ensure all required fields are accurately filled to avoid delays.

Completing the Title Transfer Process

- Visit the Local County Tax Assessor-Collector’s Office: Take all the required documents, including the signed title, bill of sale, identification, and proof of insurance, to the local county tax assessor-collector’s office.

- Pay the Applicable Fees: Pay the necessary title transfer fees and any other applicable taxes. These fees can vary depending on the county and the type of vehicle being transferred.

- Receive Your New Title: Once the title transfer process is complete, you will receive the new title in your name. Keep this title in a safe place, as it serves as legal proof of ownership.

- Register the Vehicle: Register the vehicle with the Texas DMV to obtain license plates and legally operate the vehicle. The registration process may require additional documentation, so ensure you are prepared.

Selling a Vehicle and Title Transfer

Steps to Take when Selling a Vehicle

- Prepare the Vehicle for Sale: Before listing the vehicle for sale, ensure it is clean and presentable. Consider making necessary repairs to enhance its appeal to potential buyers.

- Determine the Selling Price: Set a reasonable selling price based on the vehicle’s condition, age, market value, and any unique features it may have.

- Advertise the Vehicle: Utilize various platforms such as online marketplaces, local classified

- s, and social media to advertise the vehicle for sale.

- Negotiate with Potential Buyers: Engage with potential buyers and be open to negotiating the price. Be transparent about the vehicle’s condition and history.

Ensuring All Liens are Paid Off

- Check for Outstanding Liens: Before transferring the title to the new owner, verify if there are any outstanding liens or loans on the vehicle. Liens must be satisfied before the title can be transferred.

- Pay Off Liens: If there are liens on the vehicle, ensure that all outstanding amounts are paid off. The lienholder should provide the necessary documentation to release the lien.

Completing the Title Transfer for the New Owner

- Sign the Title: As the seller, sign the back of the vehicle title, providing the required information. Ensure that your signature matches the name printed on the front of the title.

- Provide the Bill of Sale: Prepare a bill of sale for the transaction, including all pertinent d

- etails. Both parties should keep a copy of the bill of sale for their records.

- Transfer the Vehicle’s Ownership: Hand over the signed title, bill of sale, and any other necessary documents to the new owner. Advise them to follow the required steps promptly.

- Notify the Texas DMV: As the seller, notify the Texas DMV about the sale of the vehicle within a specified period. This step helps protect you from any liabilities that may arise after the sale.

Title Transfer Fees and Taxes

Understanding Title Transfer Fees

- Title Transfer Fee: Texas charges a fee for transferring the vehicle’s title, which varies based on the county. These fees can range from a nominal amount to more substantial sums.

- Late Transfer Penalty: There may be penalties if the title transfer is not completed within a specific timeframe. Avoid these penalties by ensuring a timely title transfer.

Overview of Taxes

- Sales Tax: Texas imposes a sales tax on the vehicle’s purchase price, which is due at the time of the title transfer. The tax rate may vary depending on the county.

- Gift Tax: When gifting a vehicle to a family member or friend, certain exemptions may apply to reduce or exempt the gift tax. Consult with a tax professional for guidance.

- Donation Tax: If donating a vehicle to a charitable organization, there are potential tax deductions and benefits. Ensure you understand the tax implications of your donation.

Methods of Payment

Accepted payment methods for title transfer fees and taxes may include cash, check, money order, or electronic payment. Verify the acceptable payment methods with the local county tax assessor-collector’s office.

Title Transfer for Inherited Vehicles

Handling Title Transfers for Inherited Vehicles

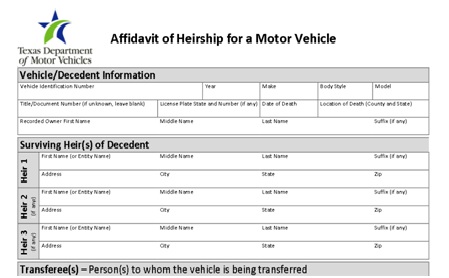

- Gather Necessary Documents: Collect all required documents, including the will, death certificate, and Affidavit of Heirship or Small Estate Affidavit.

- Obtain a Succession or Probate: If the vehicle was not transferred through a will, a succession or probate process may be required to distribute the estate’s assets.

- Apply for an Affidavit of Heirship or Small Estate Affidavit: File the necessary affidavit to prove the legal heirs and their rights to the vehicle.

Additional Steps for Transferring an Inherited Title

- Obtain Letters Testamentary or Letters of Administration: These documents grant the executor or administrator the authority to handle the estate’s affairs.

- Complete the Title Transfer: Once all the required documents are in order, proceed with the title transfer process as outlined in the previous sections.

Title Transfer for Gifted Vehicles

How to Transfer the Title for a Gifted Vehicle

- Prepare a Gift Letter: Draft a gift letter stating the intention to transfer the vehicle as a gift without any financial transaction. This letter should include both the donor’s and recipient’s details.

- Obtain the Gift Affidavit: Complete a Gift Affidavit as required by the Texas DMV. This form confirms that the transfer is indeed a gift and not a sale.

- Complete the Title Transfer: Proceed with the title transfer process, providing the necessary documentation, including the signed title, gift letter, and affidavit.

Gift Tax Implications and Exemptions

- Exemptions for Family Members: Certain family members may be exempt from paying gift taxes based on their relationship to the donor. Consult with a tax professional to determine if you qualify for an exemption.

- Consult with a Tax Professional: It is wise to seek advice from a tax professional to understand any potential gift tax implications based on your specific situation.

Title Transfer for Donated Vehicles

Title Transfer Process for Donated Vehicles

- Choose a Charitable Organization: Select a reputable charitable organization to donate the vehicle to. Ensure that the organization is eligible to receive tax-deductible donations.

- Complete the Donation Process: Follow the organization’s donation process, ensuring all necessary documentation is provided. This may include the title, bill of sale, and donation receipt.

- Obtain the Receipt: Obtain a receipt from the charity for the donation, which can be used for tax purposes when filing your taxes.

Tax Deductions and Benefits

- Tax Deduction Eligibility: Understand the eligibility criteria for claiming tax deductions on charitable donations. Keep records of the donation for tax filing purposes.

- Value of the Donation: Determine the value of the donated vehicle for tax deduction purposes. The value may be based on the vehicle’s fair market value at the time of the donation.

Title Transfer for Out-of-State Vehicles

Title Transfer Requirements for Out-of-State Vehicles

- Obtain a Vehicle Inspection: Some out-of-state vehicles may require an inspection to meet Texas’ emis

- sions and safety standards. Verify the inspection requirements with the Texas DMV.

- Complete the Out-of-State Title Transfer: Follow the necessary steps to transfer the out-of-state title to Texas. This may involve providing the current title, proof of ownership, and other documentation.

Obtaining a New Texas Title and Registration

- Visit the Local DMV Office: Visit the local DMV office to start the title transfer process. It is recommended to make an appointment beforehand to save time.

- Provide the Required Documents: Submit all necessary documents, including the out-of-state title, identification, proof of insurance, and any required inspection certificates.

- Pay the Applicable Fees: Pay the required title transfer fees and taxes at the time of registration. The fees may vary depending on the vehicle’s weight, age, and other factors.

Title Transfer for Salvage and Rebuilt Vehicles

Understanding Salvage Titles

- Salvage Title Definition: A salvage title is issued to vehicles that have been deemed a total loss by an insurance company due to damage from accidents, natural disasters, or other events.

- Implications of a Salvage Title: Vehicles with salvage titles may have limitations and challenges, as they have undergone significant damage and repairs. Insurance coverage may also be more challenging to obtain.

Steps to Transfer a Salvage Title to a Rebuilt Title

- Rebuilding the Vehicle: Repair the salvaged vehicle to a roadworthy condition. This may involve extensive repairs and inspections to ensure it meets safety and roadworthiness standards.

- Inspection Requirements: Arrange for a salvage inspection to certify that the vehicle is indeed rebuilt and meets all necessary safety requirements. The Texas DMV typically conducts these inspections.

- Submit the Required Documentation: Prepare and submit all necessary documentation to the Texas DMV for the rebuilt title. This documentation may include photographs of the vehicle’s repairs and receipts for the parts used.

Frequently Asked Questions (FAQs)

- What is the purpose of a vehicle title? A vehicle title serves as legal proof of ownership and is required for registration and transferring ownership.

- When is a title transfer necessary? Title transfer is necessary when buying, selling, inheriting, or donating a vehicle in Texas.

- Can I transfer a title online? In some cases, title transfers can be initiated online through the Texas DMV website.

- How much does it cost to transfer a vehicle title in Texas? The cost varies based on the county and the type of vehicle being transferred. Additional fees may apply for late transfers.

- What documents do I need for a title transfer? Required documents include the current vehicle title, a completed Form 130-U, proof of identification, proof of insurance, and any applicable lien release.

- Can I gift a vehicle to a family member without paying taxes? There may be exemptions for gift taxes when gifting a vehicle to a family member. Consult with a tax professional to understand the specific rules.

- How long does the title transfer process usually take? The title transfer process typically takes a few weeks, but this can vary depending on factors such as the DMV’s processing times and the completeness of the documentation.

- What if I lost the vehicle title before transferring it? If the title is lost, a duplicate title can be obtained from the Texas DMV before proceeding with the transfer.

- Can I transfer the title if there is a lien on the vehicle? A lien must be paid off and released before the title can be transferred to a new owner.

- Are there any exemptions for title transfer fees? Exemptions for title transfer fees may apply in specific situations, such as transfers between spouses or close relatives.

Conclusion

Completing a Texas vehicle title transfer is a crucial step in any vehicle-related transaction. By following the step-by-step guide provided here, you can navigate the process successfully and ensure that the ownership of the vehicle is officially and legally transferred to the new owner. It is essential to stay informed about specific requirements and consult with the Texas DMV or a qualified professional when needed to ensure a smooth and compliant title transfer process. Remember, being a responsible vehicle owner in the Lone Star State starts with completing the title transfer correctly.